Quick approval, minimal documents, and flexible repayment options

A New Financial Start Without Risking Your Assets

Every Indian household has dreams regarding starting a business, funding a child’s education, covering unexpected medical bills, or taking that long-awaited family trip. But when it comes to turning these dreams into reality, finances often become a barrier.

First-time borrowers often worry about pledging gold, property, land, or other valuable assets for a loan. Many don’t even have valuable assets to use as collateral for loans, and those who do have assets aren’t ready to risk them.

That’s where collateral-free loans take centre stage. These loans are a lifeline for first-time borrowers.

For many first-time borrowers in India, a big question that arises in their minds is: “Will I need to pledge something as security?” Many of them pledge gold, property, or other assets for a loan, especially since it’s commonly seen among first-time borrowers. But what about those who don’t have collateral, and those who do, but aren’t ready to risk it?

At Instalment Express- You don’t need to pledge or worry.

You can now get a pledge-free loan. This means you can get a loan without pledging your assets for a collateral-free loan.

Borrowers who are starting their financial journey often struggle to access credit, as many lenders won’t take a chance on them.

Lack of assets to pledge: Not everyone owns property or gold to offer as collateral.

Strict bank norms: Traditional banks take a long time to approve a loan procedure and require a lot of paperwork.

Limited loan options: The first-time buyer has the options of a smaller loan amount with a higher interest rate, or most loan applications get rejected.

Higher Interest: Charged a higher interest rate than the usual one. As the lender is risking his own amount.

No credit history: First-time applicants often have no credit score, which makes it difficult for lenders to trust.

This is where unsecured loans fill the gap, offering fast, flexible, and fair credit access.

Collateral-free loans are also called unsecured loans. In such a loan procedure, financial products don’t require you to pledge any asset, like gold, property, or an FD, as a guarantee. These loans are approved based on your income, credit score, and repayment ability. According to the RIS- Unsecured lending by NBFCs has surged. It grew by 28.1 percent, which is more than twice the 11.5 percent growth of secured loans by March 2023. Common Types of Collateral-Free Loans: Personal Loans: For marriage, education, travel, or medical emergencies. Business Loans: For working capital, expansion, or inventory purchases. Credit Card Loan: For everyday spending and to overcome the daily expenses. Mudra Loan: This loan supports small businesses and entrepreneurs with capital.

No Asset? No Problem You don’t need to put your valuable assets, such as property, land, or gold, at risk. Our offering provides peace of mind, especially for first-time borrowers in tier 2 and tier 3 cities. This helps you to save your assets and hold onto the emotions of your loved ones. For every person’s wish, Instalment Express is here with no risk. Faster Approval Collateral-based loans often take weeks for approval, but with Instalment Express, you get quick financial support. With our instant yet straightforward loan approval process you get your loan amount in your bank account within 24-48hours. Around 2 crores of loan amount is available as per the MSMED Act 2006. Flexibility in Use Collateral-free loans offer flexibility to use the capital as per your financial needs. This gives you freedom, unlike a home loan and car loan.

Helps Build Credit Scores Paying back your unsecured loan on time can boost your CIBIL score, which helps you to access higher credit in the future. Fully Digital Process

India’s credit ecosystem is evolving, and it’s becoming more inclusive with unsecured loans taking the lead.

At Instalment Express, we understand all your financial concern and the struggle you face as a first-time borrower. With our collateral-free loan we provide you a loan without any hassle of documentation, just simple, supportive, and secure loan process.

Here’s what sets us apart:

Our goal is to provide loan for every person in India who is facing the financial issue, and is eager to have a stress-free unsecured loan instantly.

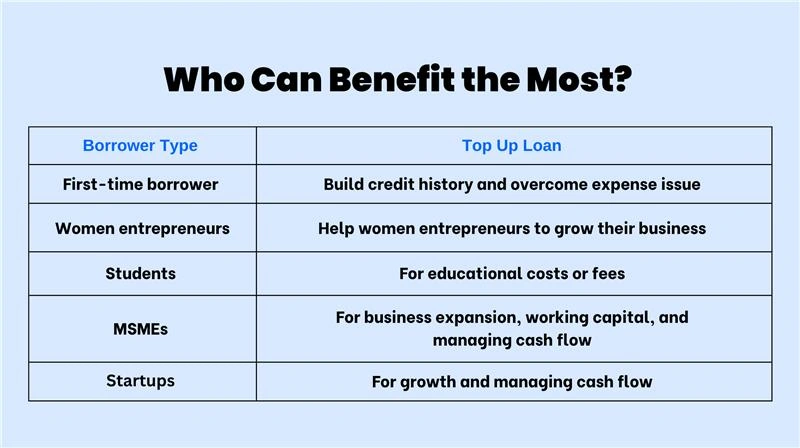

In a country with fast-growing financial independence, collateral-free loans are a crucial support to millions of Indians who are entering the credit ecosystem for the first time. At Instalment Express, we offer you the best service while providing a collateral-free loan that eliminates the need for security and empowers you to achieve your goals. We are here to help you. If you need to build a business, fund your education, or support your family, we solve your every problem.

No Collateral, No Worries

Ready to get started?

Take the first step with Instalment Express.

Fast, secure, and designed for YOU.

Apply now for a collateral-free loan today, to enjoy stress-free borrowing with no assets required and no hassle.

1. Do I need a guarantor?

No, there is no need for a guarantor to avail the benefit of the collateral-free loan in India. If you meet their eligibility criteria they won’t ask much while approving or giving you a loan.

2. How much can I borrow without collateral?

Loan amounts for first-time borrowers typically range from ₹50,000 to ₹5 lakhs. This totally depends on income and eligibility. At Instalment Express, we provide collateral-free loans for first-time buyers. You don’t need to pledge assets like property, land, gold, or any other valuable assets.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure