Quick approval, minimal documents, and flexible repayment options

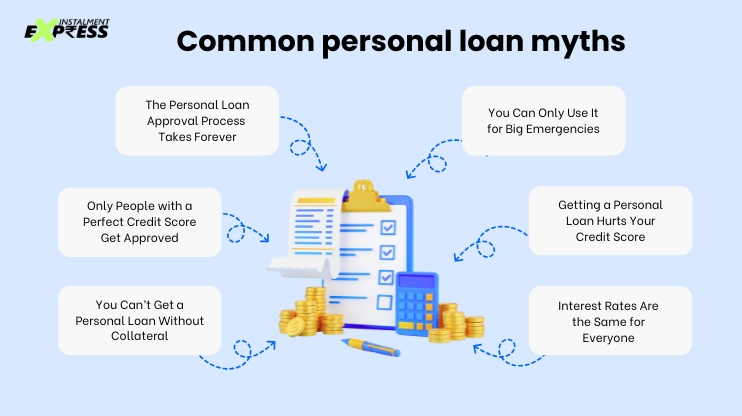

Personal loans are a lifesaver when finances are tight. Personal loans provide a quick and adaptable solution for any situation, from medical emergencies, wedding costs, or simply needing quick cash for a new device. But let’s face it, there are many myths about how they work, who are eligible for loan, and the risks involved.

Due to fraud and false information, a lot of people either avoid applying or end up in bad deals. In order to help you borrow wisely and without stress, this blog will burst the most common personal loan myths today.

Let’s start with the most important one. Many people still think that personal loans always require you to pledge assets, such as your home, car, or gold.

In reality, most of the personal loans are unsecured, meaning no collateral is required. Instead, banks and NBFCs look at your income, credit score, and ability to repay. Therefore, you can apply without risking your assets as long as your credit profile appears to be good.

Many people think that you can’t get a personal loan unless your credit score is higher than 750.

Reality: Certainly, a high score is beneficial. However, receiving a lower score does not necessarily mean that your journey is over. Although you may receive slightly higher interest rates or shorter repayment terms, many lenders offer personal loans to borrowers with lower credit scores. Some even focus on bad credit loans, particularly on online lending sites.

Therefore, don’t give up just yet, even if your score isn’t perfect.

Ten years ago, when paperwork dominated everything, this might have been the case. However, things have changed.

Reality: You can now receive immediate loan approval in minutes and disbursement within 48 hours, thanks to digital KYC and online platforms. If your documents are approved, some fintech companies will even offer loans in a matter of hours. The traditional practice of waiting in lengthy lines at banks? No longer.

You’ll breeze through the process if you just make sure your documents are up to date.

Another widespread belief is that personal loans should only be used for significant life events, such as home repairs, weddings, or surgeries.

The truth is that a personal loan can be used for nearly anything. Do you want to travel? Remodel your living area? Invest in a new phone or pay for a quick course? Lenders don’t care what you use it for as long as you pay them back on time. Just stay away from risky activities like gambling or stock trading with it.

Because it’s only partially true, this one is challenging.

The truth is that merely applying for a personal loan does not lower your credit score. How you handle it after approval is what counts. Your credit score will actually rise if you make your EMI payments on time. Avoid making several hard inquiries at once, though, as applying for too many loans in a short period of time can affect it.

A common misconception is that everyone receives the same interest rate once it is set by a lender for personal loans.

The truth is that interest rates differ among individuals. Your credit score, income, employment stability, loan amount, and even your employer all play a role. The same bank may offer 11% interest to someone with a higher score and 16% to another. Comparing lenders and offers is crucial before making a decision because of this.

Consider the following before applying:

A personal loan is ultimately merely a tool. How well you use it determines whether it benefits or harms you. Don’t allow false information or antiquated ideas to prevent you from making wise financial decisions. Additionally, avoid falling for the myths surrounding instant loans that say there is no risk or obligation.

With transparency, flexibility, and actual human support—not just automated systems—Instalment Express is here to assist you in making well-informed borrowing decisions. We can help you find a personal loan without collateral, understand your loan eligibility, or find out more about the approval process.

Ready to apply? Instalment Express makes loan approval easy. Apply now and get the personal loan for your needs!

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure