Quick approval, minimal documents, and flexible repayment options

Have you ever come across a post where your friend has recently travelled to Dubai and has posted the best pictures and reels on Instagram? And excitingly, you had a dig in his profile, where he often travels to different countries, cities, and sometimes explores the unexplored places, and when reality hits, you think, “I can’t even explore the known places.” But wait a minute, most people just travel in imagination to their dream places, killing their dreams in their minds and living with the so-called dead dreams in real life.

Where would the money come from?

In India, where most of us balance monthly EMIs, school fees, and family responsibilities, planning a vacation feels like a luxury. IN THIS BLOG, we’ll explore a very practical question: Should you fund your next trip with a travel loan or use your credit card EMI?

Both options offer instant travel finance, but which one really works smarter for you? Let’s know it briefly.

In today’s fast-paced life, dealing with personal life, office deadlines, EMI reminders, and family commitments, travel often gets pushed to the “someday to maybe” list. And when we finally plan that long-awaited vacation, the biggest barrier is not leave approval from the boss, it’s the travel budget.

Instead of dipping into savings meant for emergencies or children’s education, Indians increasingly turn to vacation loans or credit card EMI conversions. But while both may look convenient, the difference in cost, flexibility, and peace of mind is huge.

A travel loan is a type of personal loan designed to cover your travel expenses, such as flight tickets, accommodation, sightseeing, and others. It’s an unsecured type of loan where no collateral is required, and it comes with:

According to the RBI’s data, Indians spent about 1700 crore on foreign travel in FY25. (Timesofindia)

Think of it as getting your entire vacation budget in one go, without relying on a credit card with a lower limit.

Credit cards are primarily used for instant funding options with no pre-planned situations. But the credit card comes with a fixed amount limit, where you can avail just a limited amount of benefit, which may not come in use to get a huge amount.

While you’re planning to travel and considering covering expenses with credit card EMI’s, don’t focus on the convenient side, and think of repaying the loan amount in monthly installments. Consider the-

While credit card EMIs offer quick fixes, they can quietly snowball into expensive debt. Swiping the card at hotels, restaurants, or shopping isn’t the best option. The best approach is to swipe your thinking, considering the other side, so you can enjoy a stress-free life by considering the following key points.

If your vacation requires a huge funding (₹1–5 lakh), a travel loan gives you better control and lower costs. Credit card EMIs are better only for smaller spends that can be repaid quickly,

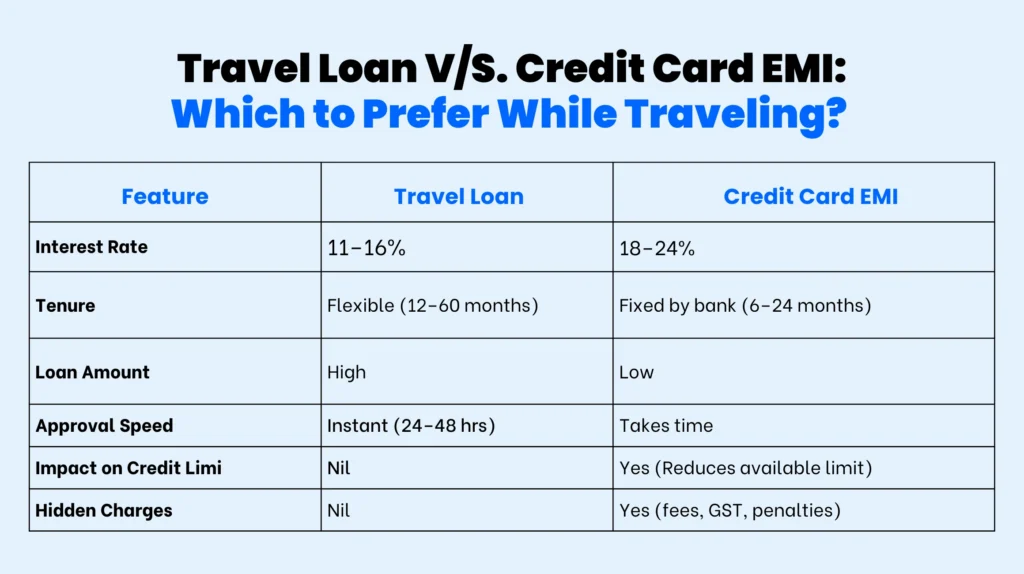

| Feature | Travel Loan | Credit Card EMI |

|---|---|---|

| Interest Rate | 11–16% | 18–24% |

| Tenure | Flexible (12–60 months) | Fixed by bank (6–24 months) |

| Loan Amount | High | Low |

| Approval Speed | Instant (24–48 hrs) | Takes time |

| Impact on Credit Limit | Nil | Yes (Reduces available limit) |

| Hidden Charges | Nil | Yes (fees, GST, penalties) |

Travel loans in India are considered more affordable, accessible, and flexible. According to a report, the number of applicants has also surged in availing the benefit of the travel loan. The rise is mostly seen due to the younger generation from Tier 2 and Tier 3 cities.

For middle-class families, newly married couples planning honeymoons, or professionals chasing their first international break, travel loans are becoming the smarter, safer bet.

According to the global tourism sector, travel loans are witnessing a spike of 20-25%. (Timesofindia)

At Instalment Express, we believe your dream vacation shouldn’t be delayed because of money stress. Here’s how we help you:

A credit card EMI might work if you plan a short trip, such as a quick domestic getaway. But for a long weekend trip, a travel loan is a smarter, cost-effective option that will make your journey more memorable.

Plan your finances before packing your bag.

Are you ready to turn your travel dream into a reality?

Apply now for an instant vacation loan with Instalment Express today and experience the best without worries.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure