Quick approval, minimal documents, and flexible repayment options

This fast-moving world waits for no one. Whether it’s time, money, or relationships, once it’s gone, you miss out on valuable opportunities. Likewise, the need for funds can arise at any moment, and that’s when quick loans come to the rescue.

During such times, business and startups owners need easy access to quick business loan. 2025 marks the year with the highest demand for quick loan. It doesn’t matter if you urgently need capital to expand your business, cover large operational costs, or explore new opportunities, quick loan is your reliable financial partner, always there when you need it.

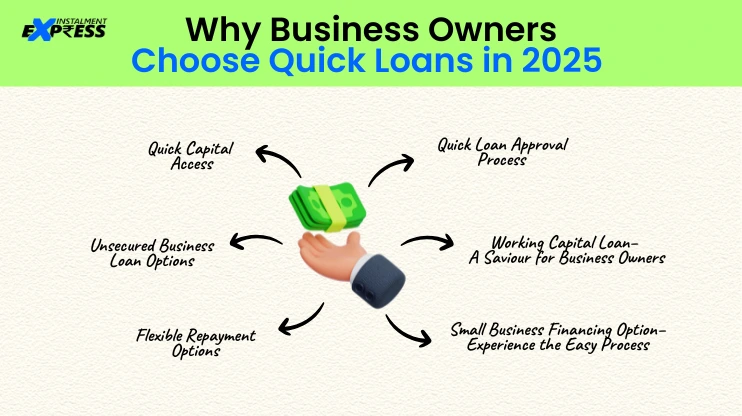

Here are key reasons why business owners are prioritizing quick loans in 2025:

Instalment Express is the first choice for loan borrowers, offering fast, private, and hassle-free loans tailored to you.

a) Immediate Cash Flow: Due to the long processing time of a traditional loan, people no longer consider it a viable option. On the contrary, a quick business loan offers a series of benefits, such as quick processing within days or even hours, fast approval process, and transparent policies.

b) Seize Opportunities: You never know when you’ll need urgent cash for your business. At such times, having access to fast business loan approval makes life easier when you need funds immediately.

a) No Collateral Needed: Traditional loans required a series of formalities to get approved by lenders. This discouraged business owners from seeking financial assistance. However, quick business loan comes with fast loan approval-without risking your personal or business assets.

b) Easy Approval: Quick access to funds, fast approval, and a simple application process make a quick loan top choice for business and startup owners.

a) Easy Repayment Plans: Along with numerous other benefits, a quick loan allows business owners to repay as per their convenience with tailored repayment options.

b) Early Repayment Options: Many lenders offering a quick loan enable borrowers to repay early to avoid penalties. This benefit gives business owners more control over their finances.

a) Easy Applications: Quick loan allow borrowers to apply from the comfort of their phone screens. This saves a lot of time and energy for business owners. With minimal documentation, and quick approvals, quick loan is the top choice for small business financing.

b) New Business Opportunities: If you’re planning to start your small-scale startup, but a low credit score is holding you back, aquick loan has you covered. You can avail yourself of the loan of your choice.

Lenders like Instalment Express provide a quick loan with zero collateral, low CIBIL score requirements, and a fast approval process. Get your loan now!

a) Covers Business Expenses: If your business needs urgent cash for covering operational costs such as rent, salaries, utilities or even the entire inventory, then relying on a working capital loan can be a smart decision.

b) Easy Cash Flow: A working capital loan helps businesses bridge the gap between investment, expenses, and ROI. This ensures smooth business operations during unfortunate revenue periods.

a) Hassle-Free Process: People no longer need to pile up their documents on a lender’s desk to get a loan. Loan providers like Instalment Express approve a loan with minimal documentation, such as identity proof and a few essential documents. Learn more about Emergency loan documentation.

b) Quick Approval: The easy online and offline application process ensures fast document verification and approval. Now, you can experience fast business loan approval in just a few hours!

A quick loan is the go-to-choice for business owners, and it’s hard to ignore its amazing benefits. Many startups and businesses face major financial challenges just because they don’t receive proper financial help. But don’t let this happen to your business!

Instalment Express offers the best quick loan plans to cover the financial needs of businesses. From business capital to emergency business funds, we take care of your financial requirements.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure