Quick approval, minimal documents, and flexible repayment options

Several factors are considered while applying for a loan, and among them, CIBIL score is an essential factor. Loan lenders consider credit scores when providing loans to the borrowers. Several factors are considered while applying for a loan, and among them, CIBIL score is an essential factor. Loan lenders consider credit scores when providing loans to the borrowers.

A CIBIL score is a three-digit numerical. It signifies the creditworthiness of an individual typically ranging from 300 to 900. It is estimated as per your credit history, repayment behaviour, credit utilization, and other financial aspects.

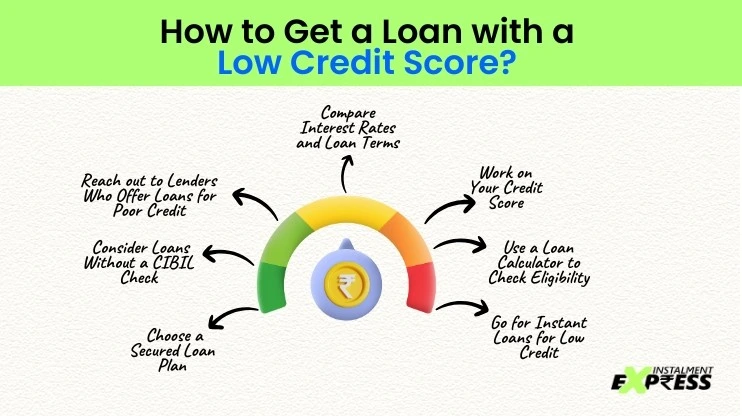

A strong CIBIL score, or credit score, is preferable for quick loan approval. Meeting the criterion of a high credit score is challenging for people aiming for a loan but having a low credit score. However, there are still multiple roadmaps for getting a loan approved by the lenders.

Loan lenders rely majorly on CIBIL score as it signifies your credit history, repayment transactions, and overall financial responsibility towards repayment. Getting a loan with a low credit score can be challenging, but lenders like Instalment Express focus on offering ease to the loan borrower even if they have a low credit rating.

Loans are the saviour of people in their difficult situations. Financial stability is a privilege that can be achieved with loans. Whether you want to buy a home, a car, fund your education or to expand your business, loans can be the lifeline for you.

Loans maintain a uniforms cash flow even when you have a low CIBIL score. This financial security thus allows you to manage unexpected expenses and make important investments for the long run. Take a look at how you can avail the best loan plan even with a low CIBIL score.

Banks like NBFCs or fintech lenders don’t just focus on your credit score but also on your income and repayment capacity. These lenders can be your first choice in case of bad credit personal loans.

While taking such types of loans, the lender doesn’t consider credit score. As a result, you can avail loans without a CIBIL check.

Factors like uniform income, financial stability, and previous repayment history are subjected instead of a CIBIL check.

Simplify loan borrowing with Instalment Express today.

Even though unsecured loans provide the best benefits for your loan requirements, opting for a secured loan plan isn’t that bad. Secured plans offer quick approval chances by offering collateral such as gold, property, or fixed deposits.

Therefore, if you have a low CIBIL score and still want great loan options, then secured loans are for you.

Simultaneously working on improving your credit score is equally important if you want the best loans.

Here’s how you can improve your credit score:

Use the loan calculator available on Instalment Express’s website. This calculation will pitch an idea about the loan plan specially made for you.

Using a loan calculator to check loan eligibility helps you estimate the loan amount you qualify for along with a readymade repayment plan.

Lenders like Instalment Express have the best instant loans for low CIBIL scores. With minimal documentation and quick loan approval, we ease the financial requirements of our borrowers.

Explore different interest rates and repayment structures that suit you. Individuals with a low CIBIL score can get their hands on the best loan deal looking for lenders offering flexible repayment options.

Comparing interest rates, loan terms, and payback structure offers ease during financial strain.

Financial insecurities should never be the reason to hold you back. At Instalment Express, you don’t have to worry about your low credit score, as we offer:

1. Easy Application Process:

Online & offline applications are available with minimal documentation.

2. Quick Loan Approval:

Get your loans as fast as possible with our quick approval and disbursal times.

3. Flexible Repayment Structure:

Pay as per your need with our favourable repayment plans made just for you.

4. No Strict CIBIL Score:

We assess applications based on income and repayment and not just your CIBIL score.

Getting a loan during a financial emergency can be a breakthrough. But with a low credit score, the situation can worsen.

During such times, it’s wise to choose the right lender, like Instalment Express if you need a bad credit personal loan, a loan without a CIBIL check, or an instant loan for a low CIBIL score.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure