Quick approval, minimal documents, and flexible repayment options

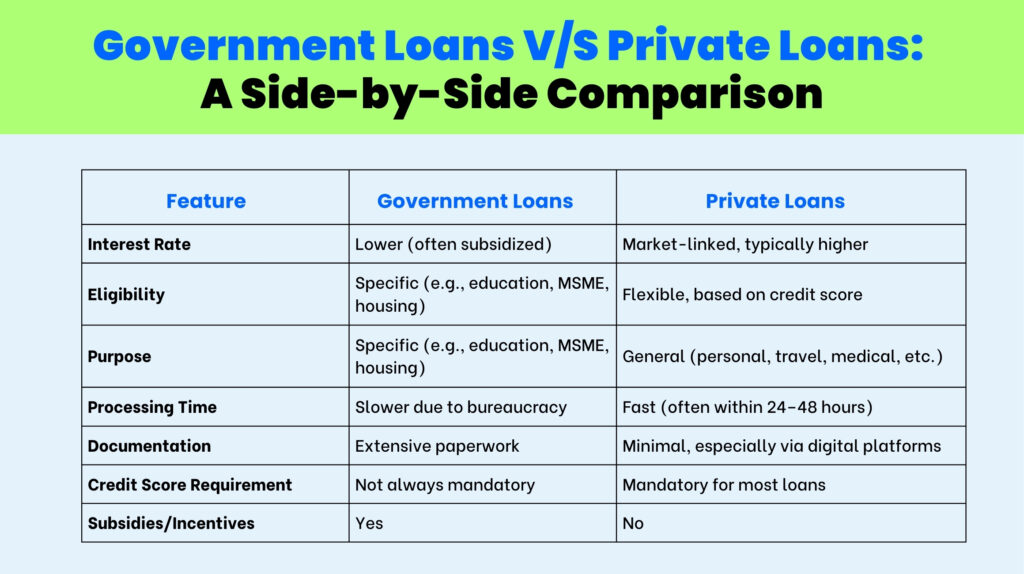

When it comes to borrowing money, whether it is to fund education, start a business, buy a home, or an emergency case, there are mostly two broad options that a person considers, they are government loan schemes and private loans. These have their own positives and negatives, but choosing the right one impacts not only your finances, but it also affects your long-term financial health.

This blog will help you in guiding through the pros and cons of government loans and private loans, so next time, you can confidently decide what’s best for your specific needs

These loans are backed by the government and are mostly offered via public banks or agencies. They’re part of larger efforts to support students, farmers, small business owners, and first-time homebuyers—basically anyone the government thinks needs a helping hand.

These loans are given by the banks, NBFCs, or digital lenders, basically, the non-government sources. They’re a lot faster to get and more flexible in terms of what you can use them for.

Financial matters can be overwhelming. But picking between government loans and private loans isn’t about right or wrong—it’s about what fits you best. Government loans are like slow-cooked meals—more affordable, but they take time. Private loans? Fast food, quick and satisfying but might cost you more.

At Instalment Express, we help people find the best fit, whether that’s a low-interest government loan or a super-fast private loan. You don’t need to be a finance geek to get it right. Just know your needs, your repayment ability, and your timeline.

Thinking about a loan?

Let’s help you figure it out. Head over to Instalment Express and see your best options today.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure