Quick approval, minimal documents, and flexible repayment options

We’ve all had those moments where we needed money yesterday. An unexpected bill pops up, your salary is delayed, or something breaks at home that just can’t wait. And in those moments, turning to friends or family might feel awkward… or just not an option. That’s exactly, when a small cash loan can be your lifesaver and do the job for you.

Quick, simple, and usually without the headache of long paperwork, small personal loans have become a go-to option for many Indians who need urgent financial support. In this blog you will get the answers of why small cash loans from Instalment Express are best for you and why it is the right place to get started.

A small cash loan is a short-term personal loan that typically ranges from ₹5,000 to ₹1,00,000, depending on your need and eligibility. These loans are designed to meet immediate, urgent, often unplanned expenses. These acts as your financial cushion during tough times.

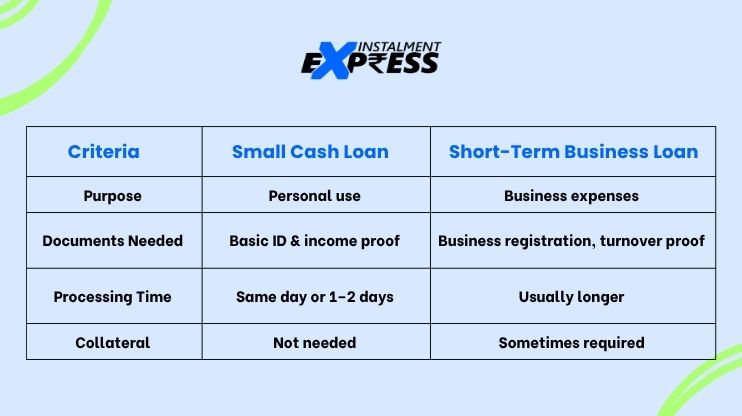

Unlike bigger long-term business loans or home loans that need extensive documentation, small cash loans are more flexible and faster to access.

Some common situations where a small loan can help are listed below:

In short: if it’s urgent, unplanned, and can’t be delayed—a small cash loan might be your best move.

You could use a credit card, but here’s the catch: not everyone has a high credit limit, and if you’re already carrying a balance, the interest adds up fast. Most credit cards charge 30% or more annually, while a small loan may offer you a much lower interest rate, especially if you repay on time.

Also, credit cards are less flexible in terms of EMIs and repayment tenures, whereas small loans allow you to choose a repayment period that fits your budget.

Here’s what makes Instalment Express stand out:

So, unless you’re borrowing for your company, a small personal loan is the better fit.

At Instalment Express, we’ve kept our eligibility simple so more people can access financial help:

Even if you have an average credit score, don’t worry. We assess your overall profile, not just numbers.

Applying for a small personal loan on Instalment Express is as easy as ordering food online:

While small cash loans are helpful, you need to borrow smartly:

Emergencies don’t wait, and neither should you. A small cash loan from Instalment Express is a simple, fast, and secure way to manage those financial hiccups that life throws at you.

Whether you need money for a family emergency or just to get through the month, we’ve got your back. Flexible amounts, transparent terms, and lightning-fast approvals mean you don’t have to stress when things get tough.

Apply now at Instalment Express and get cash when you need it most.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure