Quick approval, minimal documents, and flexible repayment options

In today’s world of digital payments and consumer convenience, how we pay is almost as important as what we pay for. Whether it’s a new gadget, an emergency medical bill, or a spontaneous vacation, the two most common payment options are EMIs (Equated Monthly Installments) and credit card payments. Each comes with its own set of benefits and limitations.

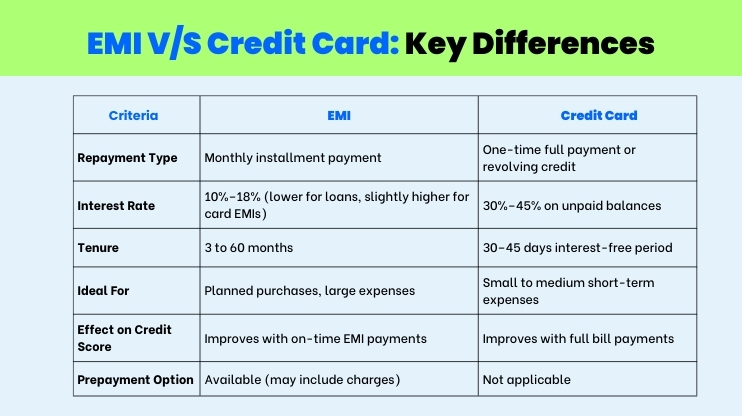

So, when faced with the choice, EMI vs. credit card—which one should you choose?

This blog will help you break down both options, compare their financial impact, and guide you toward the better choice depending on your goals.

When a a person pays loan in the smaller, equal payments over a fixed period of time, generally done on a monthly basis is known as an EMI. The amount includes both the principal and interest depending on the terms and conditions.

A credit card offers a buy-now-pay-later model, where a person can spend up to a certain credit limit and repay it during your billing cycle. If paid in full before the due date, no interest is charged.

Let’s say you’re planning to buy a ₹50,000 laptop. Paying in full using a credit card might be convenient, but if it strains your monthly budget, the smarter choice might be an installment vs. one-time payment approach through EMI.

Sometimes, your credit card provider will offer an EMI option at checkout. While convenient, it’s not always the best deal compared to a personal loan.

Criteria | Credit Card EMI | Loan EMI (Personal Loan) |

Speed | Instant conversion | 1 – 2 day approval |

Interest | Higher than loans | Competitive rates |

Flexibility | Limited tenure options | Wide range of tenure options |

Eligibility | Based on card limit | Based on income & credit score |

Pro tip: Use Instalment Express to explore loan EMI plans with lower interest rates and greater flexibility before opting for credit card EMIs.

There’s no one-size-fits-all answer. Both EMIs and credit cards can be powerful tools—when used wisely.

At Instalment Express, we offer transparent and flexible EMI plans to help you manage big purchases without financial strain. Whether you’re choosing between installment vs. one-time payment or considering a credit card EMI conversion, we’re here to guide you toward the smartest choice.

Take control of your spending today.

Explore EMI plans with Instalment Express and make every payment smarter.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure