Quick approval, minimal documents, and flexible repayment options

In today’s fast paced world, financial security is essential than ever. Having access to emergency funds can make a significant difference, and this is when emergency loan come in to back you up. Life is unpredictable. And you never know what unexpected turns you might face. Incidents like unexpected bill payments, medical emergencies, and home renovations can bring an overwhelming financial crisis.

In such unfortunate emergencies, the importance of emergency funds becomes clear. Fortunately, there are some great ways to access funds quickly.

In this blog, Instalment Express will guide you through the essential steps to take when you need an emergency personal loan.

The demand for personal loans has surged in recent years. More and more people are turning to personal loans for medical emergencies, immediate cash, or other urgent needs. In these situations, the need for quick loan approval becomes critical.

If you are someone looking for the best loan plan out there, Instalment Express can be your financial partner. Instalment Express offers fast, private, and hassle-free loans just for you!

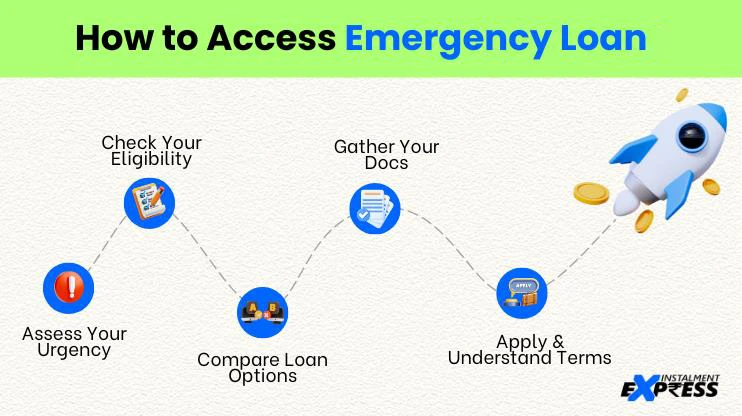

1. Examine Your Financial Urgency

You first step should be assessing your financial need. Give yourself a moment to understand the nature and requirement of the money.

Consider the following questions before applying for any emergency personal loan:

Breaking down your situation based on these questions will help you gain an overview and make informed decision.

2. Check Whether You’re Eligible for a Loan

While emergency personal loans are high in demand and relatively accessible, certain norms are considered to receive loans from lenders.

To determine how likely you are to avail an emergency personal loan, consider these aspects:

3. Explore Multiple Loan Options

The loan structure of each lender varies. Go for loans with lower interest rates and practical repayment options to avoid any further financial burden.

Look at these terms to choose the suitable loan plan for you:

4. Keep Your Documents Ready!

Getting a personal loan can be a lengthy process, but with right documents, you can get quick loan approval.

These documents typically involve:

Paperwork can be a real hassle, but with Instalment Express, you can access quick loan approval effortlessly. We provide emergency personal loans with minimal documentation and easy application process.

5. Apply for the Loan

Apply for the loan once you are ready with a suitable loan plan and required documents. Submit the application to the lender, either online or in person. Be honest and accurate about your income, expenses and the purpose of the loan.

6. Online Loan Application

In this digital world, everything is online and so can be your online loan application. Experience a seamless online loan application process with Instalment Express to get an instant personal loan. With our online application process, you can get quick approval, saving a lot of your time to get an immediate cash loan.

7. Learn Loan Terms and Conditions

Carefully reviewing the terms and conditions of loan provider is equally important. Be aware of lender’s norms and conditions to avoid any confusion in the future.

Pay attention to:

Financial emergencies don’t arrive with a warning? Therefore, having immediate access to financial solutions is a must. When selecting a loan plan, make sure to take wise steps, and borrow responsibly, consider several options, and choose a trusted lender.

Instalment Express offers smooth and secure quick loans. Your trust is our responsibility. Secure your funds now!

If you’re looking for a loan with quick approvals, minimal paperwork, and a hassle-free process, Instalment Express is the perfect solution. Apply today and experience the future of simplified borrowing!

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure