Quick approval, minimal documents, and flexible repayment options

Running a small or mid-sized business often feels like walking a tightrope—especially when your cash flow is stretched thin. You’ve completed a big order, your clients are happy, but your money is stuck in unpaid invoices. Meanwhile, bills don’t wait. Payroll needs to go out. Suppliers are calling. And you’re wondering, how do I keep things moving?

That’s where invoice financing steps in. It’s not some complex financial tool reserved for large enterprises. In fact, it’s designed to help businesses like yours turn unpaid invoices into instant working capital.

Let’s unpack how invoice financing works and how it can help you keep your cash flow smooth, even when clients are slow to pay.

Invoice financing also known as invoice factoring or an accounts receivable loan is a way for businesses to get immediate funds based on their outstanding invoices.

Here’s the simple version:

So essentially, it’s a business cash flow loan tied directly to your receivables.

Traditional loans require credit checks, lengthy paperwork, and sometimes collateral. But with invoice financing, your receivables become the asset.

Here’s why it’s popular among SMEs:

For businesses in manufacturing, services, wholesale, or logistics, invoice financing can be a game-changer.

Invoice financing works best when:

It’s not meant for long-term borrowing, but it’s perfect for bridging the gap between delivery and payment.

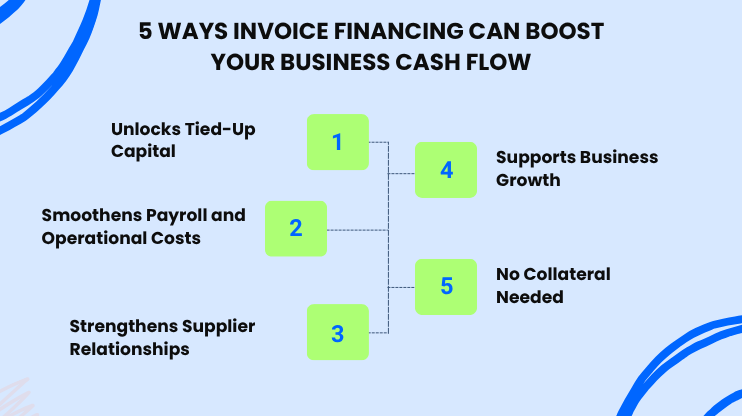

Here’s how smart use of invoice financing can give your business a liquidity lift:

Instead of waiting 30-90 days, you get access to funds instantly. This liquidity can help you grab new opportunities without delay.

No more stressing during month-end. You can keep your teams paid and operations flowing—even when client payments lag.

Early payments to suppliers = better terms and discounts. Invoice financing gives you that negotiating edge.

Use the released funds to take on more orders, expand inventory, or invest in marketing. Scale without cash-flow hiccups.

Unlike traditional loans, invoice financing doesn’t demand property or equipment as security. Your invoices are enough.

Not all providers are the same. Here’s what to look for:

Pro tip: Always read the agreement carefully and ask questions—especially about recourse vs. non-recourse factoring.

Invoice financing isn’t just a band-aid for cash flow stress—it’s a strategic tool for growing businesses. If your money is stuck in unpaid invoices, this could be the key to unlocking it and fueling your next big move.

Whether you call it invoice factoring, an accounts receivable loan, or simply a way to boost your business cash flow—the value is real.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure