Quick approval, minimal documents, and flexible repayment options

Have you ever faced a situation where, 2 years ago, you took a home loan from a bank with the best offers you wished for? In the current situation, with the existing loan, you still need an amount for your child’s higher education. But you are left with no liquid capital, just solid stress to solve the issue for the betterment of your child’s future.

Don’t worry if such instances trigger you; reach out instantly to Instalment Express, a trusted partner who solves every funding problem with a safe and secure process.

A top-up loan is simply an additional loan that your bank or lender gives you over your existing loan, whether it’s a home loan or a personal loan. Since you’re already an existing customer, the process is usually quicker and requires minimal documentation.

In short, if you’ve been a responsible borrower with timely repayments, lenders reward you with quicker access to extra funds.

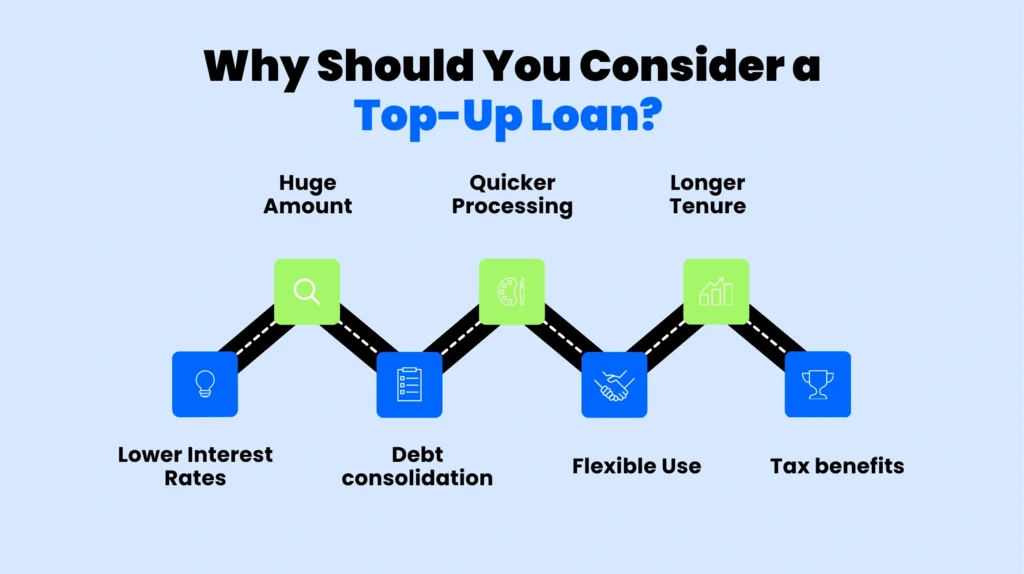

A top-up loan offers several advantages, including less documentation, a shorter waiting period, and quicker approval. Here’s why you should consider it:

Currently, the RBI has reduced the repo rate by 0.50 basic points (bps).

If you have a ₹40 lakh home loan and need ₹5 lakh more for renovations, instead of taking a costly personal loan, you can request a top-up on your existing loan.

The right time to consider a top-up loan is when you are looking for an instant funding option to overcome a particular emergency. Also, it’s necessary to have an existing loan with a good repayment history. Below are the key situations you can think of using a top-up loan: Emergencies: Sudden family or medical expenses where funds are required on an instant basis. Planned Expenses: Big life events like marriage or higher education abroad. Debt Refinancing: Pay off high-interest loans (like credit card dues) with a top-up loan at a lower rate. Home Renovation: When you need extra funds to renovate your home without disturbing your savings, a top-up loan can be an ideal choice. Taking advantage of lower interest rates: As for top-up loans, the banks provide lower interest rates as compared to fresh loans. If your repayment history is good, you’re offered the best plan, which includes a lower interest rate to help you overcome the particular instance or take advantage of the offer.

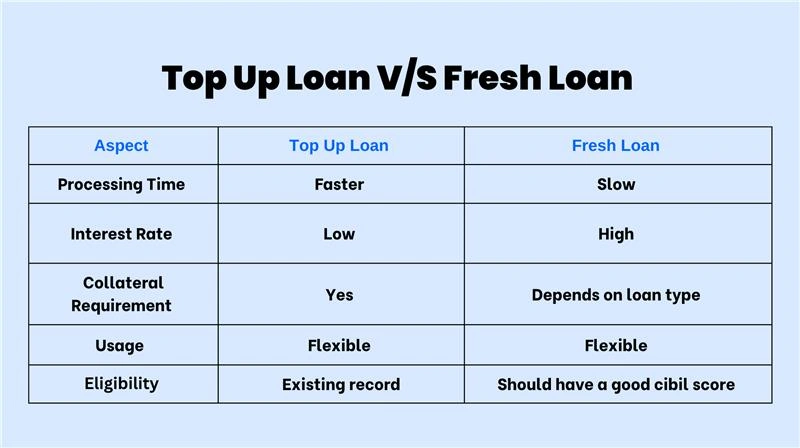

Many confuse top-up loans with loan refinancing. Here’s the difference: Top-up Loan: Getting extra funds over your current loan with the same lender. Loan Refinancing: Shifting your entire loan to another lender for better options and with a lower interest rate than the previous one. Both the loan processes are helpful, but serve different purposes. If you need additional funds on an existing loan, go for a top-up. If your existing lender’s rates are high, consider refinancing with another lender.

With Instalment Express, you can get a top-up loan instantly through a safe and secure process. After submitting minimal documentation, you can avail the benefit of the top-up loan and can achieve your financial goals. Submit the following documents to get a top-up loan now:

If you’re an existing customer with a good repayment history, you will receive the loan amount within 48 hours, without issues.

A top-up loan can be a smart financial option if used wisely. Instead of juggling between multiple high-interest loans, pay one time with the top-up option to decrease your interest amount, lower your stress, and enjoy your financial freedom to the fullest.

Need quick funds without the hassle of a new loan?

Get a top-up loan today from Instalment Express for quick approval and flexible repayment options.

Start your stress-free financial journey now.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure