Quick approval, minimal documents, and flexible repayment options

Looking for a Lower Interest Rate Option? Here’s what you need to know.

Have you ever wondered why some people prefer a loan against property over a personal loan, especially when both help meet urgent financial needs? If you’re looking for a huge loan amount for- child’s higher education, expanding your business, or consolidating high interest debt, property backed loan might be the smarter and most cost-effective choice.

Let’s understand why a loan against property (LAP) offers better interest rates than a regular personal loan? And most importantly, is it the right move for you?

A personal loan is an unsecured loan, where no collateral is considered for a particular loan amount. Lenders are taking more risk by offering you an unsecured personal loan, so they-

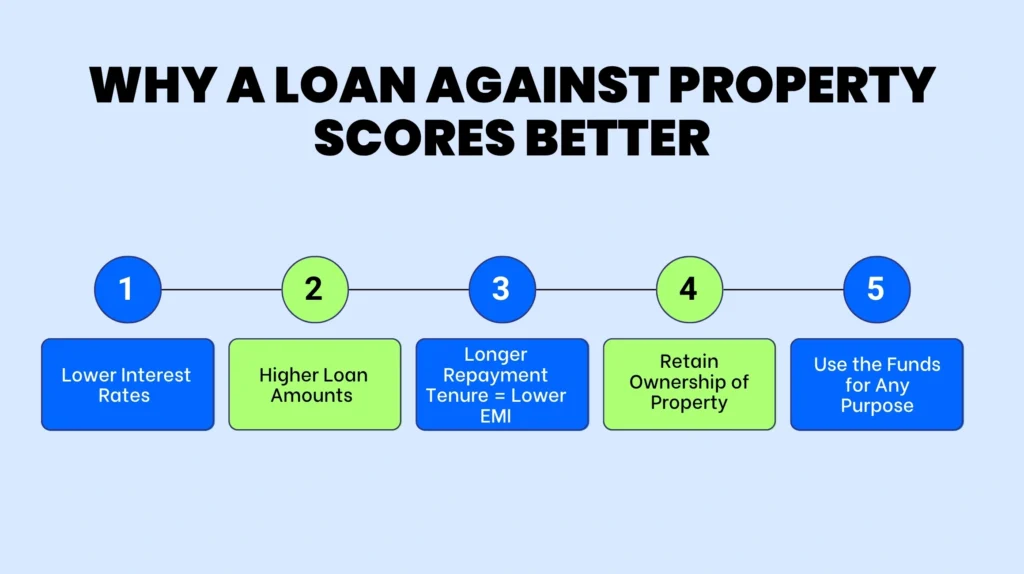

A loan against property (LAP) also known as secured personal loan, offers you to pledge your residential or commercial property as collateral, reducing the lender’s risk, and they reward you with:

As the loan is backed by your real estate, banks and NBFCs are more confident about repayment. This:

Think of it: Personal loan interest rates in India range from 10.5% to 30%. Where a LAP usually offers rates between 8.5% to 12%. These rates depend on your profile and the lender.

With a property-backed loan, you can access larger amount, up to 60-80% of the property’s current market value. This makes it ideal for business expansion, child’s higher education, or any other once in a lifetime funding’s been considered.

LAPs usually have longer repayment duration- lasting 15-20 years. In contrast personal loans typically last 3 to 5 years. This helps you manage EMIs better and plan your financial budget efficiently.

Contrary to common belief, pledging your property doesn’t mean losing control over it.

Like a personal loan, a loan against property can be used for:

You’re not restricted, and Instalment Express ensures a smooth, transparent process with no hidden charges, as most of them charge 1% or 10,000, whichever is higher in amount, including the GST as applicable.

A loan against property is ideal when:

Feature | Personal Loan | Loan Against Property at Instalment Express |

Type of Loan | Unsecured | Secured (collateral-based) |

Interest Rates | 10.5% – 24% | 8.5% – 12% |

Loan Amount | Up to ₹40 lakhs | Up to ₹10 crores |

Repayment Tenure | Up to 5 years | Up to 15–20 years |

Processing Time | Fast (2–3 days) | Faster- Just 48 hours |

EMI Burden | Higher | Lower due to longer tenure plan |

Early payments to suppliers = better terms and discounts. Invoice financing gives you that negotiating edge.

At Instalment Express, we simplify the process for salaried professionals, business owners, and self-employed individuals. With personalized LAP solutions across India, here’s what you can expect:

Calculate your EMI now or speak to a loan expert at Instalment Express today.

In today’s world, making smart financial choices is crucial. Using your property can be a strategic way to borrow at lower interest rates without compromising liquidity. A personal loan against property is more than just a loan, it’s a way to use what you already own to build what you want.

Whether you’re an entrepreneur looking to grow your business or a parent planning your child’s education abroad, Instalment Express is here to guide you every step of the way.

Talk to our loan experts today and unlock the best offers on property-backed loans.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure