Quick approval, minimal documents, and flexible repayment options

Let’s face it—Indian weddings are magical, but they don’t come cheap. From the glimmering outfits and five-day functions to catering, photography, and decor, the numbers can add up real quick. While families still pitch in, many modern couples are now taking the reins of their wedding expenses. But what if your dream wedding doesn’t quite match your current bank balance?

That’s exactly where a wedding loan can be a life-saver.

Instead of draining your savings or compromising on what matters to you, a loan for wedding expenses can help you finance your big day—smoothly and stress-free.

A wedding loan is a type of personal loan designed to cover all expenses related to your wedding. Since it’s unsecured, you don’t need to pledge any asset like property or jewellery to get it.

Whether you’re planning an intimate destination wedding or a big-fat shaadi, this loan helps you manage the budget without cutting corners.

You can use it for:

Basically, everything you need to make your celebration memorable.

Here are some solid reasons why a wedding loan makes more sense than you might think:

From big cities to small towns, people are increasingly turning to wedding loans to fund:

Weddings today are not just family functions—they’re personal statements, and financing them with a wedding loan makes it easier to meet those expectations.

If you’re wondering how to go about it, the process is refreshingly simple:

To qualify for a wedding loan, you typically need:

Work out a realistic budget for your wedding. Take stock of what you can fund and how much you need. Don’t over-borrow—it just adds pressure later.

Go to Instalment Express, fill out a simple form, upload documents, and hit apply. The application barely takes few minutes.

Once your documents are verified, your loan is approved, The amount is directly transferred to your bank account in 48 hours.

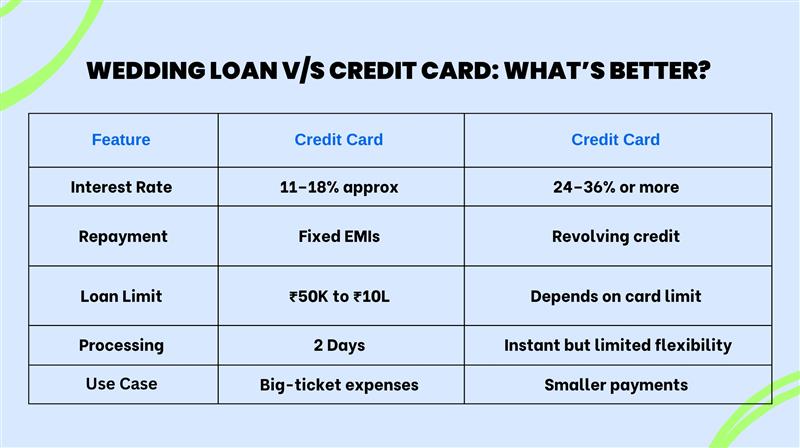

While cards may seem convenient, they’re not ideal for high-cost events like weddings. A loan gives you better control and predictable EMIs.

Before signing that loan agreement, here are a few pro tips:

Your wedding is once in a lifetime. You should be able to celebrate it your way, without cutting corners or losing sleep over money.

With wedding loans from Instalment Express, funding your special day becomes smooth, fast, and stress-free. Whether you’re planning a grand celebration or an intimate affair, the right financial support can make all the difference.

Apply now and take the first step toward the wedding you truly deserve.

Visit Instalment Express and check your wedding loan eligibility today.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure