Quick approval, minimal documents, and flexible repayment options

Upgrading or purchasing new machinery can be a game-changer for your business. But hefty upfront costs often stand in the way of your growth plans. That’s where an equipment financing loan comes in handy. With minimal down payments and flexible repayment tenures, you can get the tools you need now and pay later—keeping cash flow healthy while boosting productivity.

In this guide, we’ll walk you through what an equipment financing loan is, why it might be right for your enterprise, the equipment loan eligibility criteria, and how to apply step-by-step.

An equipment financing loan is a type of business loan specifically designed to help companies purchase or lease machinery and equipment. Unlike traditional term loans, the equipment you buy often serves as collateral, which reduces the lender’s risk and can result in better rates.

Common uses include:

Because the lender can repossess the equipment if repayments aren’t made, you typically get more favorable terms than unsecured borrowing.

Before diving in, it helps to know the basic equipment loan eligibility criteria lenders usually consider:

If you meet these requirements, you’re well on your way. If not, you might consider a co-applicant or guarantor to strengthen your application.

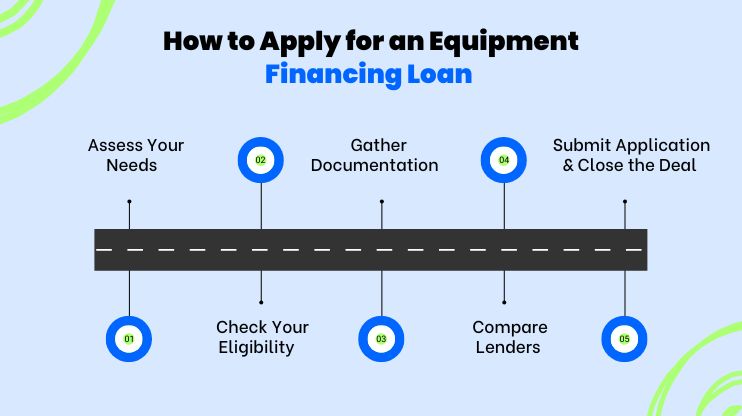

Applying doesn’t have to be painful. Follow these 5 simple steps to secure the funding you need:

List the exact machinery you require—model, cost, and seller details. Avoid vague requests; lenders appreciate precise project plans.

Use online calculators or eligibility checkers on lender websites. This gives you a realistic idea of the loan amount and rate you can expect. Don’t waste time applying to lenders you don’t qualify for.

You’ll generally need:

Having everything ready speeds up the process.

Interest rates, processing fees, prepayment penalties, and customer reviews vary widely. Consider banks, NBFCs, and fintech platforms. Choose a lender whose terms are tailored your needs.

Apply online or visit a branch. Once approved, review the sanction letter carefully—especially the EMI schedule and any late-fee clauses. Sign and get your equipment supplier paid directly by the lender.

These small steps can make a big difference in how quickly you get the funds—and at what cost.

Most equipment loans are secured, meaning the machinery itself is collateral. This offers lower rates but puts the asset at risk if you default. Some lenders offer unsecured equipment financing, where no collateral is needed—but interest rates are usually higher, and eligibility criteria tougher.

Decide which risk-reward balance makes sense: if the gear is critical to operations, you might prefer lower rates and accept the security requirement. If you can’t pledge assets, be prepared to pay a bit more for flexibility.

An equipment financing loan lets your business grow without depleting capital or missing out on new opportunities. By understanding equipment loan eligibility, comparing offers, and following a clear application process, you can upgrade your gear, increase efficiency, and stay competitive.

At Instalment Express, we offer quick, transparent equipment loans with flexible tenures and competitive rates—so you can seize that machinery upgrade without hesitation.

Ready to gear up? Visit Instalment Express and check your equipment financing eligibility today. Let’s power your business forward!

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure