Quick approval, minimal documents, and flexible repayment options

A personal loan is an unsecured loan that can be used for various personal needs, including medical emergencies, education, travel, or debt consolidation. Unlike secured loans, personal loans do not require collateral, making them accessible to a wide range of borrowers. Some examples of personal loans are Wedding Loan, Travel Loan, Gadget/Electronic Loan, Agriculture Loan, Small Cash Loan, Vehicle Loan, Salary Advance Loan, Medical Loan, Educational Loan, Loan Against Property (LAP).

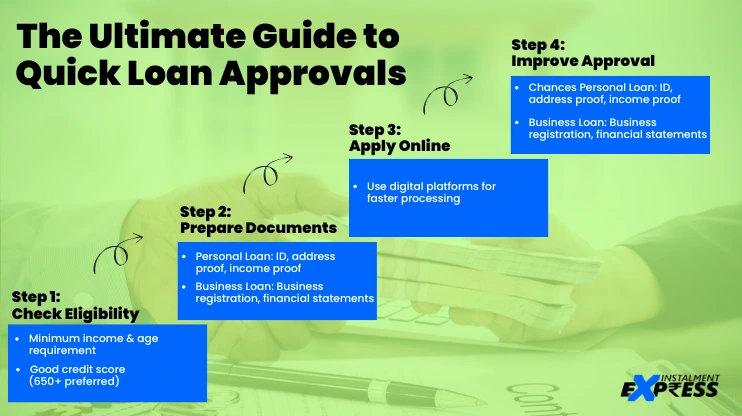

To increase your chances of getting a personal loan quickly, ensure you meet these basic eligibility criteria:

Understanding the quick loan approval process can significantly increase your chances of securing a loan without unnecessary delays.

To ensure a seamless and quick loan approval, avoid these common mistakes:

Whether you need a personal loan for an emergency or a business loan to scale your venture, understanding the quick loan approval process is crucial. By following these steps, you can ensure a hassle-free loan application experience and secure the funds you need efficiently.

Are you ready to apply for a loan? Explore our options today and get the financial support you need without unnecessary delays.

With Instalment Express, getting a loan is fast, easy, and stress-free.

Instant

Basic Docs

Secure